Spreading Trust Signals: A Running List of My Podcast Appearances

One of the best parts of writing a book is getting to talk about it after it's published! You spend...

It’s been a tough year for Kim Kardashian. She has been in the headlines more than ever – and a lot of it not being good news. Recently, Kim agreed to pay a $1.26 million settlement to the SEC for unlawfully touting crypto security. While many are focusing on what this could mean for the Kardashians’ image, there are also some serious implications for influencer trust going forward.

When it comes to our finances, we should be careful about who we take advice from. With the rise of social media, anyone can give their opinion on financial matters - whether they are qualified or not. And with the power of influencers, these unqualified opinions can seem like gospel truth. At a time when more Americans say they are experiencing financial stress, they can be more vulnerable than ever to quackery.

So, should we trust financial influencers?

To get to the bottom of this question, we will discuss in this article what happened with Kim Kardashian, why we should be wary of influencers, trust signals to look for in finance influencers and red flags. We will also be giving a list of people that deserve your attention for being trustworthy finance influencers.

When it comes to social media influencers, it can be hard to know who to trust. After all, anyone can put up a pretty profile and call themselves an expert. However, when it comes to financial tips, you should be especially careful who you listen to.

Social media influencers have a lot of power when it comes to promoting products and services - but that doesn't mean you should always trust them. Case in point: Kim Kardashian was fined on October 3, 2022 by the SEC for promoting a cryptocurrency called EthereumMax without disclosing that she was being paid to do so. While Kardashian isn't technically a financial advisor, she has a huge following on social media, and her endorsement of EthereumMax led many people to invest in the coin.

Specifically, Kardashian failed to disclose that she was paid $250,000 to publish a post to her Instagram account about EthereumMax, containing a link to the coin’s website and indirectly providing instructions to potential investors wishing to purchase the tokens.

However, it turned out to be a fraud - and now, those who lost money are suing Kardashian.

On the topic, SEC Chair Gray Gensler commented that "Ms. Kardashian’s case also serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities."

This just goes to show that even big names can't always be trusted when it comes to financial advice. So, while an influencer's endorsement may make a product or service look more trustworthy, it's always important to do your own research before investing. So, if you're looking for someone to give you financial tips, make sure you do your research first and only take advice from reliable sources. And if you want to start investing or trading, always consult an accredited financial advisor first before you start yourself.

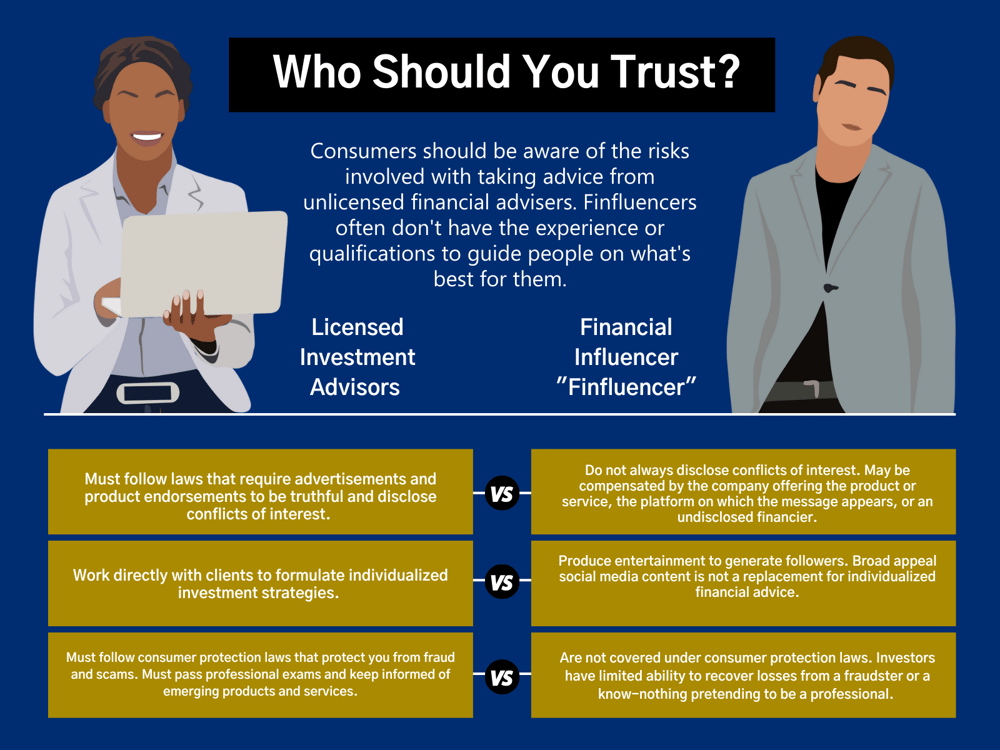

A financial influencer (finfluencer) is somebody who has a large following on social media and who offers advice on financial topics, such as investing, saving money, and debt management.

Many finfluencers are bloggers or YouTubers who share their own experiences and offer tips to their followers. Some financial influencers are certified financial planners (CFPs), which means they have the training and experience to help people make sound financial decisions. But not all financial influencers are CFPs. In fact, many of them don't have any formal training in personal finance at all.

Many people follow finance influencers because they believe that they can trust them to give accurate and unbiased information. However, there are some risks associated with trusting a financial influencer.

First of all, it's important to remember that just because someone has a large following, it doesn't necessarily mean that they're an expert on the subject. It's also worth bearing in mind that many financial influencers are sponsored by companies, which means that they may not be giving impartial advice.

If you're thinking about following a financial influencer, it's important to do your research first. Make sure that you understand their qualifications and experience, and take a close look at any sponsored content to see if it's biased. If they're a CFP, then they probably know what they're talking about. But if they're not, then it's up to you to decide whether or not you think they can provide helpful and accurate advice.

Once you've done your homework, you can then decide whether or not you think you can trust the person.

Image Credits: Department of Financial Protection & Innovation, California

There's no doubt that social media has changed the way we consume information. In particular, platforms like Instagram and YouTube have given rise to a new breed of information influencers. And while there are many benefits to this trend, it also means that we're more likely to encounter false or misleading information.

So, how can you tell if an influencer is trustworthy? If you're looking for someone to help you make sense of the world of finance, following influencers who exhibit these eight characteristics is a good place to start.

Here are eight signs to look for:

When it comes to financial influencers, it's important to be careful. There are a lot of people out there giving advice, but not all of them have your best interests in mind. Watch out for the red flags below – if you see any of them, proceed with caution. The last thing you want is to end up in a financial hole because you trusted someone who wasn't looking out for your best interests.

When it comes to finance, it can be tough to know who to trust. With so many conflicting voices out there, it's hard to know who has your best interests at heart. But don't worry - we've compiled a list of the top 5 financial influencers that have proven trustworthy so far. From money-saving tips to investment advice, these experts will help you get your finances in order. So check out our list and start following financial peace of mind today!

Note: although you can follow these finfluencers to get financial tips and tricks, you should consult a financial advisor if you're in financial trouble or want to start investing or trading yourself.

1. @thebudgetmom – For anyone on a budget (and let's be honest, who isn't these days), The Budget Mom is a must-follow. With tips and tricks on everything from couponing to cutting back on expenses, she's helped her followers save millions of dollars collectively. And she doesn't just preach the gospel of frugality - she walks the walk, too. In fact, she managed to pay off $38,000 of debt in just 18 months! She's been featured in major publications like Forbes and The Huffington Post, and her advice is solid.

1. @thebudgetmom – For anyone on a budget (and let's be honest, who isn't these days), The Budget Mom is a must-follow. With tips and tricks on everything from couponing to cutting back on expenses, she's helped her followers save millions of dollars collectively. And she doesn't just preach the gospel of frugality - she walks the walk, too. In fact, she managed to pay off $38,000 of debt in just 18 months! She's been featured in major publications like Forbes and The Huffington Post, and her advice is solid.

2. @thebudgetnista - Tiffany "The Budgetnista" Aliche is an award-winning teacher of financial education. She is the author of Get Good with Money (a New York Times Bestseller), The One Week Budget, and the Live Richer Challenge series.

3. Dave Ramsey – He is a well-known personal finance expert, and his advice has helped millions of people get out of debt and build wealth. Ramsey is the author of the famous “7 baby steps” that allows people to take control of their money; he is all about effective wealth management.

4. Suze Orman – Orman is another well-known financial expert, and she has a lot of experience helping people make smart decisions with their money. Suze Orman is a #1 New York Times Bestselling author on Personal Finance, with over 25 million books in circulation, available in 12 languages worldwide.

If you're wondering whether or not you can trust finance influencers on social media, the answer is yes - but only if you do your research. There are a lot of fake influencers out there who are only in it for the money, so it's important to be careful who you listen to.

Do some digging and make sure that the person you're following is legitimate before taking any advice. With a little bit of effort, you can find someone who can help you make sound financial decisions.

When it comes to finding a good financial influencer, there are a few things you should look out for. Avoid anyone who is not transparent about their finances, constantly pushes products, only posts advertised content or has fake reviews.

There are plenty of other finance influencers out there who can provide valuable information without trying to scam you. Follow someone who is honest and helpful, and who you can trust to give advice that will help you reach your financial goals.

Perla is a doctoral student at Notre Dame Law School. She loves writing and sharing knowledge with others.

One of the best parts of writing a book is getting to talk about it after it's published! You spend...

Ulysses S. Grant was a great man—the leader of the Union Army and the 18th president of the United...

Leave a Comment