Trust Signals Live: The 'Breadcrumbs of Trust' That Lead to Purchase

I've begun broadcasting live on LinkedIn, Facebook and YouTube to get the word out about trust...

(Following is Chapter 9 of Trust Signals: Brand Building in a Post-Truth World.)

An ancient Latin proverb offers some good advice about priorities: “Duos insequens lepores neutrum capit.”

He who chases two hares catches neither.

In today’s world, marketers and business owners are faced with a seemingly unlimited number of rabbits to chase—and an equal number of rabbit holes to avoid.

It would be easy enough if our post-truth world consisted of one audience that watched CNN and another that preferred Fox News. The tougher challenge is that every audience’s attention is spread across many sources of information and influence.

Without carefully prioritizing the trust signals you send, you risk spending unlimited marketing dollars to achieve limited results— and sometimes no results at all.

Let’s take the issue of information sources. To use your budget wisely, it’s critical to gain an understanding of:

Faced with these questions, you could do what many marketers do—nod your head impatiently and say, “We’ll figure that out with A/B testing. We’ll eliminate what fails and double up on what works.”

WHY CUSTOMER RESEARCH SAVES YOU MONEY IN THE LONG RUN

You could do that, but it would cost you—probably far more than the research you have decided to skip.

Specifically:

Media Coverage

It can cost thousands of dollars in agency time to achieve one high-profile media placement. Shouldn’t you make sure you’ve targeted the right source?

Influencers

Whether paid or unpaid, influencers require an investment of time and money. And choosing the wrong ones can actually hurt your brand.

Review Sites

Which review sites should you prioritize? You can’t ask your customers to leave reviews for you in six different places. You have to focus on the sources that move the needle.

Think about my friend David, from the breakfast meeting. His company had landed ten million dollars in venture capital. It had happy customers. It had a story to tell. And yet, despite spending a sizable retainer with a PR agency for a year, the startup saw only a modest increase in brand awareness and trust.

Why?

Mostly because the company and agency both assumed that securing media coverage in high-profile outlets—-no matter how difficult or time-consuming these placements were to achieve—was the startup’s best PR investment. If David’s startup had hired an agency that focused not just on media coverage but on that cover- age’s ultimate purpose—securing trust at scale—the engagement might have gone differently.

But only if the brand first conducted research to determine which trust signals would have the greatest impact.

KNOWING WHO YOU ARE AND WHAT YOUR AUDIENCES WANT FROM YOU

Trust Signals is a book about brand building, not brand creation. Having said that, before we dive into research strategies to identify the best trust signals to grow your brand, now might be a good time for you to do a gut check on a fundamental question:

Do you know who you are?

In this book, we discuss universal truths about branding, such as the importance of authenticity, quality, and consistency in sharing your story. But what that means specifically is different for every brand. Be sure you have created a solid brand narrative before sharing it with your audiences if you want to earn their trust.

Knowing who your company is as a brand means being able to look in the mirror and answer these questions, among others:

Once you are confident about who you are, you can use trust signals to tell your story to the world.

DECIDING WHICH TRUST SIGNALS TO PURSUE AND SHOWCASE

As important as trust signals are, they are not universal in their appeal. What resonates with one audience may not resonate with another.

That’s why achieving brand trust is a far more complex under- taking now than it was in the past. In this cancel-culture world, the stakes are higher, too.

Decisions about which trust signals to pursue and showcase, and which to avoid or ignore, shouldn’t be made lightly. Calibrate them carefully for risk versus reward.

Questions to ask yourself include:

To answer these questions, it’s not enough to gather a group of executives in a boardroom, compile their conjectures on a whiteboard, and call it a strategy. You must first conduct research to ensure your trust-building plan is a solid one.

During this research, your objective is to discover what messages and sources inspire trust, as well as distrust, in your buyers and other audiences.

Their answers may surprise you.

MOVING FROM SMALL TALK TO REAL CONVERSATIONS

Have you ever been to a party where you didn’t know anyone? What was that first conversation like? If it’s anything like my experiences, it was awkward—a lot of small talk, uncomfortable pauses, and questions asked out of courtesy rather than curiosity.

Compare that to a gathering where everyone already knows each other. Those parties are fun. The conversations are meaningful. The interactions are memorable.

If, as a brand, you haven’t taken the time to get to know your buyers, you are perpetually at that first party. You’re sending out marketing messages and hoping for a response. Maybe you’ll hit on something that resonates. But more likely the buyer will simply flash a polite smile and find someone more interesting to talk to.

How can you avoid that—and get to that second party? The best way to start is with buyer persona research.

CONDUCTING BUYER PERSONA RESEARCH

A buyer persona is a semi-fictional representation of your ideal customer based on research into your existing buyers. It encompasses demographics, behavior patterns, motivations, and goals.

My agency, Idea Grove, conducts a range of research and strategy projects for our clients, including brand audits, competitive analyses, go-to-market plans, and more. But the research we do most often is to help our clients create buyer personas.

Idea Grove uses a methodology based on the work of Adele Revella, founder of the Buyer Persona Institute and author of Buyer Personas: How to Gain Insight into Your Customer’s Expectations, Align your Marketing Strategies, and Win More Business, one of the best business books of the past decade. If you haven’t read it, I encourage you to do so.

Consistent with Revella’s approach, our team conducts Zoom or phone interviews with recently added contacts in our clients’ CRMs—some who ended up purchasing our client’s product, others who chose a competitor, and still others who chose not to buy at all.

THE PROBE METHODOLOGY

We call our approach PROBE, and it’s designed to elicit the fol- lowing information:

Problem: What was the pain point or problem the buyer hoped to solve?

Results: What results did the buyer expect to see from purchasing the product?

Obstacles: What concerns or objections did the buyer have during the process?

Buyer’s Journey: How did the buyer find out about the product and what were the stages in the buying process?

Evaluation: What factors led to the buyer’s final decision?

It’s difficult to overstate how much our clients have benefited from this research over the years. It has inspired brands to overhaul their marketing strategies, redesign their websites, update their messaging, or make other important changes to better align with buyers.

STUNNING RESULTS, VALUABLE INSIGHTS

Consider the example of one of our clients, a managed service provider (MSP) offering IT consulting services in multiple markets. The MSP was struggling to differentiate itself in its heavily crowded space and asked for our help.

We quickly learned that it was nearly impossible to distinguish our client’s website from those of its competitors. They mostly consisted of laundry lists of services and capabilities, along with tired marketing appeals touting the benefits of outsourcing IT for small businesses.

Then, we began doing buyer persona interviews for this client. What we found was stunning.

None of the information on the company’s website was of particular interest to those we talked to; in fact, there was frustration over the technical jargon and lack of transparency about pricing. But what made these buyers choose our client came shining through—it was their high-touch service, which stood apart in this highly commoditized space.

As one respondent told us:

They actually got to know us during the sales process. I liked the stories they shared. They seem to like visiting their clients at their offices. Everybody else I talked to was cold by comparison; they insisted they could do everything remotely. Honestly, the other guys sounded like they’d consider the engagement a success if they never had to meet us at all.

This insight led to a complete overhaul of the brand’s website, in which we put personal interactions, case studies, and experiences—rather than speeds and feeds—front and center.

You’ll recall we discussed in Chapter 5 the power of custom photography as a website trust signal. The warm and intimate shoot we did for this client made all the difference in differentiating the brand.

THE LIMITS OF BUYER PERSONAS

The data we gathered in our buyer interviews helped us determine which trust signals to prioritize. In addition to the custom photography, we added case studies in which long-time customers told candid, sometimes humorous stories of their experiences with the company’s employees.

And rather than spend thousands of words describing the technologies of our client’s IT partners (major brands like Microsoft), we simply displayed their logos on the site. That was all visitors really needed to see to trust in our client’s competence.

But buyer persona research does have its limitations. While essential, it is no longer sufficient to build a trust-centered marketing program.

Why?

Because today’s customers care about more than your product. And because buyers aren’t the only audience whose opinions matter.

Let’s explore each of these sea changes in more detail.

SEA CHANGE #1: TODAY’S CUSTOMERS CARE ABOUT MORE THAN YOUR PRODUCT

It’s not just about your product’s features and benefits anymore. When buyers make purchase decisions, they often factor in whether the brand is one they wish to align with—based on the brand’s social purpose, political stances, and other considerations.

These factors fall outside the scope of most buyer persona research. They are also questions that most brands never had to worry about in the past.

Three decades ago, when NBA great Michael Jordan was questioned about his decision not to publicly endorse a Black Democrat for the US Senate in his home state of North Carolina, he swatted away the challenge with the swagger of a chase-down block.

“Republicans buy sneakers, too,” the face of the Air Jordan brand famously responded.

Jordan, then twenty-seven, took a bit of heat at the time. But his attitude reflected the stance of most brands in 1990: stay out of politics.

Consumers Want Brands to Represent Their Values

Over the past decade, particularly after the election of Donald Trump in 2016, things have changed. Americans routinely call on corporate CEOs to take stands on social issues. With our politics mired in dysfunction and gridlock, millions no longer feel represented in Washington. They are now demanding to be “represented” by their favorite brands.

The global PR agency Edelman has been studying public trust for two decades. For its 2022 Edelman Trust Barometer report, the firm conducted interviews with more than 36,000 respondents across twenty-eight countries in the form of a thirty-minute online survey.

The results were gloomy, as expected, for most public institutions—with one exception: business.

According to the report, business has emerged as the most trusted institution, surpassing government, the media, and even nonprofit groups (2022 Edelman Trust Barometer). This tracks with a trend of increasing trust in business in Edelman’s studies over several years.

CEOs Are Expected to Step Up

But as Spider-Man’s Uncle Ben might say, “With great power comes great responsibility.”

According to Edelman’s research, about eight in ten respondents want CEOs to speak out on issues such as social injustice. More than two-thirds of respondents expect a CEO to step in to fix a problem when the government refuses to act.

This transformation in public expectations is evident across virtually every business and industry—including Jordan’s NBA.

The face of the league today is LeBron James. Unlike Jordan, James is fearless in sharing his values and views. And at thirty-seven, he’s already a billionaire—with 30 percent of that wealth coming from his salary and 70 percent from endorsements, entertainment deals, and other non-NBA sources.

LeBron knows his audience. He’s built a career o the court by showing his fans who he is off the court—creating closer bonds in the process.

Consumers want their favorite brands to represent their values. They will buy from, advocate for, and trust those that do. But they will punish those that don’t.

A survey of consumers by the B2B review site Clutch demonstrates this clearly:

Buyer persona research is typically not geared to address this broader universe of motivations.

SEA CHANGE #2: BUYERS AREN’T THE ONLY AUDIENCE WHOSE OPINIONS MATTER

Recall how the writer for PRSA’s (2015) PRsay blog described the difference between marketing and PR:

Marketing addresses consumers of a product or service. Public relations is the strategic function that addresses all of an organization’s key constituencies.

Buyer persona research is a marketing tool. Its name alone explains who it’s designed for—buyers. Not investors, employees, suppliers, partners, or community activists.

Not too long ago, most brands—particularly midsize and smaller businesses—didn’t worry much about “constituencies” other than their customers.

Who had time to, after all? And what constituencies did they really need to worry about?

Even Small Companies Must Consider Non-Customer Audiences

Sure, all companies had to take care of their employees. But broader concerns like corporate social responsibility, investor relations, political activism, crisis communications, and community outreach? Those were for the big, not the bit, players.

That’s no longer the case. No company, of any size, can afford to ignore their non-customer audiences and the impact they can have on their brand.

I get my hair cut at a neighborhood salon in Dallas. Some time back, the salon began getting dozens of vicious phone calls—and one-star reviews—from people all over the country. Why? Because people had confused the salon’s name with that of another local parlor, whose owner had been weighing in on controversial issues on social media.

My salon was able to clear up the confusion and live to tell the tale—but they learned the hard way that their world now extends well beyond the people sitting in their styling chairs.

TRUST PROFILES: PR’S ANSWER TO BUYER PERSONAS

Buyer personas are by and for marketers. That’s their strength and also their limitation.

The issue of trust—extending to non-product concerns and non-customer audiences—is a PR issue. And it needs a PR solution rooted in research.

My recommended solution is the trust profile.

The trust profile is a PR analog to the buyer persona. The goal of a trust profile is to help brands understand what inspires trust (and distrust) in their audiences, in the same way that buyer personas shed light on customers and the buying process.

My hope is that PR practitioners will embrace this kind of research as their responsibility—and that as such, they will become the keepers of trust for brands. PR people should make it our business to understand the “prejudices and symbols and cliches and verbal formulas” that make people tick, as Edward Bernays had envisioned.

One PR agency, the billion-dollar global firm Edelman, has taken steps in this direction.

In addition to its annual Trust Barometer survey, the agency has launched the Edelman Trust Management practice, as well as the Edelman Trust Institute, to conduct research and consult with clients on brand trust.

“Society is at an inflection point,” the institute’s chairman said upon its launch in 2021, “and we believe that trust is a defining business metric for companies and brands” (Edelman 2021).

Unfortunately, conducting custom research into brand trust with Edelman is financially out of reach for the vast majority of companies. But these businesses still need insight into what makes audiences tick—and trust.

![]()

SIDEBAR: THE BLIND LEADING THE BLIND

If I’ve heard the question once, I’ve heard it a thousand times:

So, which publications would you like to be featured in?

That’s what PR firms typically ask their new clients by way of “research.”

They might as well say:

We don’t know your audience, where they consume information, or who they trust. Can you tell us?

And most clients don’t know the answer to the question, either.

What PR should be doing is actual research—enough to develop and present a plan. As in:

These are the sources of third-party validation your target market seeks out and trusts. Focus your efforts on these three things.

Because when data is lacking, superficial goals, like getting the CEO in Forbes to feed his ego, tend to become the “strategy.” Or worse.

I was once approached by a prospective client that had a great story to tell—one I believed could earn widespread media attention. Unfortunately, the CEO already had a very specific goal in mind: he wanted to be on Fox News and Fox Business—

and nowhere else.

The CEO had no real basis for this decision, and certainly no research to support it. He was simply a conservative Republican who truly believed the only credible major news networks were owned by Fox. The rest were “fake news”—and he didn’t want to be associated with them.

Needless to say, the CEO’s PR plan was doomed from the start. Because it isn’t what he believes is fake or real that matters; it is what his buyers and other audiences believe.

And that can only be determined through research.

![]()

HOW TO BUILD A TRUST PROFILE

While every brand’s needs are different, here’s a three-step approach to building a trust profile that will work for most companies:

Let’s explore each of these steps.

Step #1: Determine Which Audiences Are Important to You

Most senior PR professionals report to the CMO or vice president of marketing for a simple reason. For most brands, the customer is far and away the most important audience.

But today, other audiences are critically important as well. Amid the pandemic-driven Great Resignation, many of my agency’s clients told us that their biggest issue wasn’t sales; it was recruiting. They were having to turn away customers because they didn’t have enough people to do the work.

These brands understand that raising awareness and building trust with job seekers—and making advocates of their employees— can make or break their business.

So it is with other audiences, such as investors. Whether your brand is a public company, a startup looking for VC money, or a small business seeking a loan, your reputation precedes you—and adds to or subtracts from the bottom line.

For tech brands, channel partners might be your lifeblood. For local service businesses, a visible presence in local communities is key. Identify your most important audiences—then get to work understanding what makes them trust.

Step #2: Analyze How Your Audiences Talk and Think

A decade ago, IBM famously estimated that 90 percent of the world’s data had been created in the previous two years—2.5 quintillion bytes of data every day. The accumulation of data online, including millions of tweets, Facebook comments and TikTok videos, has only accelerated since then (Bhambhri 2012).

That’s a gold mine of information—if you know what you’re looking for.

I’ve referred several times now to this quote from Edward Bernays, because it was so prescient when he wrote it in 1928:

Modern business must have its finger continuously on the public pulse. The voice of the people expresses the mind of the people . . . composed of inherited prejudices and symbols and cliches and verbal formulas . . . (Propaganda)

Before diving into quantitative surveys, I recommend putting your finger on the pulse of your target audiences by using AI tools to sort through the treasure trove of relevant data already online. Sentiment-and-language analysis is the kind of research Bernays could only dream of—and it’s become increasingly accurate and affordable.

Social media listening software that detects when your brand is mentioned positively or negatively online is one of the most common forms of sentiment analysis. Tools can analyze your media coverage for positive or negative tone as well.

But building a trust profile requires going deeper than that. You need to understand how your audiences talk and what’s important to them.

At Idea Grove, for example, one of our resources is software that analyzes the words and language that brand audiences use in customer reviews, on Twitter, in online forums, and elsewhere. This helps us understand how audiences talk about our clients’ brands relative to their competitors—while surfacing the words, phrases, and ideas that resonate most.

Among its many uses, this information is invaluable for creating a website that makes your visitors feel at home. If your content reads like your visitors talk, chances are they’ll step right in and stay a while.

![]()

SIDEBAR: WHAT BRAIN SCANS TELL US ABOUT TRUST

Marketers have begun to explore the use of neuroimaging— functional MRI brain scans—in determining what trust signals have the biggest impact on specific audiences.

In 2019, academics Luis-Alberto Casado-Aranda, Angelika Dimoka, and Juan Sánchez-Fernández published a study, in the Journal of Interactive Marketing, in which they used neuroimaging to compare the reaction of online shoppers to website trust signals (“Consumer Processing of Online Trust Signals”).

The researchers tested three types of signals:

The study, conducted at the University of Granada in Spain, monitored twenty-nine shoppers in the purchase process for a book. They were shown the Confianza Online security trust seal; a ratings table featuring five-star and near five-star ratings for the bookseller; and statements by the bookseller providing assurances on shipping, privacy, and security.

The research showed that trust seals were the most trusted by shoppers and the star ratings least, with assurance statements somewhere in the middle. The report stated that “third-party certificates are far more trustworthy than rating systems given the activation in previously hypothesized ventral striatum and septal areas.”

Translation: the Confianza Online security seal activated parts of the brain showing trust, while the star ratings activated parts of the brain revealing feelings of ambiguity and risk. Interestingly, this is despite the fact that in an accompanying survey, the study participants rated these trust signals as virtually identical in influence.

Previous neuroimaging research has tested the impact of variables like pricing and website usability on shopper trust.

As the cost of neuroimaging has come down in recent years, studies of this kind represent a feasible way for marketers to compare a specific audience’s reactions to different potential trust signals—and to get more accurate results than a survey might yield.

![]()

Step #3: Survey Your Audiences to Reveal Their Values and Views

Unlike with buyer persona research, it’s impossible to build a trust profile based exclusively on qualitative data.

The reason is simple. Buyer personas are about finding the common threads that drive your customers’ purchase decisions. Brands rarely need more than two or three personas. Buyer Persona Institute founder Adele Revella argues that the goal of marketers should be to narrow their focus to a single persona if possible. That way your marketing dollars can deliver more bang for the buck.

At Idea Grove, it rarely takes us more than eight to ten interviews to identify a brand’s buyer personas. By asking the right questions, we are able to identify themes in buyer motivations and goals, obstacles to purchase, and decision criteria fairly quickly. This is consistent with Revella’s experience in thousands of inter- views she and her team have conducted.

Think of buyer persona research as following a buyer down the marketing funnel and documenting the decisions they make along the way. It’s like watching a lab mouse work their way through a maze. The peanut butter or dried banana they discover upon solving the maze is your product or service. Your job is to figure out how they got there, why they went there, and how to replicate and scale that experience.

A trust profile is a different kind of research. You’re not following someone’s path to purchase. You’re not in the funnel with them. You’re above the funnel—out there where people are just living their lives and not thinking about you at all. What are they thinking about? What do they care about? What makes them angry? What information sources do they rely on in their day-to-day lives?

If you ask eight to ten people these questions in phone interviews, you’ll get eight to ten different answers. You won’t be able to make heads or tails of it.

But if you survey one thousand or more individuals among your target audiences, patterns will start to develop. The scales will fall from your eyes. And you’ll begin to understand how to earn your audiences’ trust.

Let’s say you are most interested in your customer audience and your employee audience. If you’re an established company with a decent-sized customer base, start with the contacts in your CRM. Tell them you want to get to know them better in order to better serve them. Oer them an incentive to participate. Do the same with your recruiting database for your employees and candidate pool.

If the numbers don’t add up to be statistically viable, supplement the contacts from your own databases with lookalike audience builders. These tools help create target audience lists by identifying social media users with similar characteristics, interests, and behaviors as your existing customers.

Once you have enough contacts, fire off a survey that dives into all the key questions we’ve covered in this book.

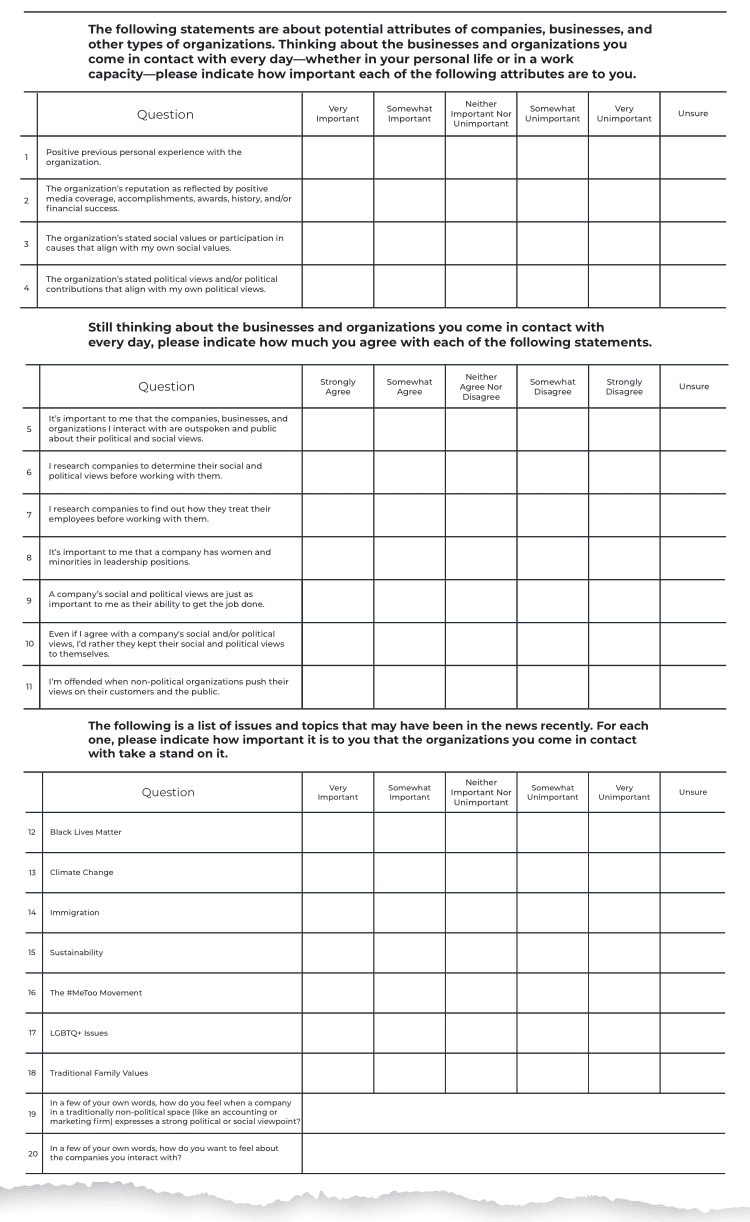

A SAMPLE TRUST PROFILE SURVEY

Without going into too much detail, and recognizing that every brand is different, I want to give you a sense of what a trust profile survey might look like. Here’s an excerpt from a survey we conducted with Cygnal, a Washington, D.C.-based political- and market-research firm.

A survey of this kind can help you understand what your audiences want before you develop a social purpose strategy, take a stand on an issue, or respond to social media activism or complaints.

With the same approach, you can ask your target audiences about their trusted (and distrusted) information sources, website trust signals, review sites, and online influencers. Depending on your needs and audience, this research can be performed in a single survey or in a series of surveys conducted over a period of months.

Together with your buyer persona research and AI analysis, you should then have the information necessary to create trust profiles for each of your core audiences that detail the:

It’s everything you need to begin a Grow With TRUST program.

Scott is founder and CEO of Idea Grove, one of the most forward-looking public relations agencies in the United States. Idea Grove focuses on helping technology companies reach media and buyers, with clients ranging from venture-backed startups to Fortune 100 companies.

I've begun broadcasting live on LinkedIn, Facebook and YouTube to get the word out about trust...

As the digital world continues to expand, content creators search for methods that allow them to...

Leave a Comment